As the amount received in advance is earned, the liability account should be debited for the amount earned and a revenue account should be credited. Under the accrual basis of accounting, revenues received in advance of being earned are reported as a liability. If they will be earned within one year, they should be listed as a current liability.

Here, the income can be earned even when the cash has yet not been received. Expenses that are to be charged in the future or simply the future expenses that are paid in advance are known as prepaid expenses. In this, the benefit of the expenses being paid in advance is recognized. They are initially treated like assets their value is expensed over time onto the income statement. Additionally a similar situation occurs if a customer is invoiced in advance of the services being provided. This is more fully explained in our unearned revenue journal entry example.

Journal Entry for Outstanding Expense

The cash received will be recorded as the unearned revenue which is present as the current liability on balance sheet. When the products are delivered to customers, the company will reverse the liability to the sales revenue. Advance payments can assist producers who do not have enough capital to buy the materials to fulfill a large order, as they can use part of the money to pay for the product they will be creating. It can also be used as an assurance that a certain amount of revenue will be brought in by producing the large order. If a corporation is required to make an advance payment, it is recorded as a prepaid expense on the balance sheet under the accrual accounting method. Advance payments are recorded as assets on a company’s balance sheet.

- If the advance payment is not received, the service will not be provided.

- The credit to the liability account is made because the company has not yet earned the money and the company has an obligation to deliver the goods or services (or to return the money) to the customer.

- The first requirement, therefore, is to read the question carefully to find out what has to be done for each non-current asset.

- For example, an employee who is paid at the end of each month for that month’s work would be receiving a deferred payment.

Similar adjustments may be needed for income, such as rent receivable. Income received in advance (i.e. deferred income) is a liability and should be included alongside accruals for unpaid expenses, thereby changing the heading to ‘Accruals and deferred income’. Income in arrears (i.e. accrued income) is an asset which should be included with prepayments using the heading ‘Prepayments and accrued income’. ‘Income received in advance, as the name suggests, is the earned revenue which is to be earned in the future in an accounting period but is already received in the current accounting period. On 30 January, the company has completed the service for customer.

Accounting for Unearned Income or Revenue

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Mr. Green Light, a commission agent, received $3,600 on 1 July 2016 the difference between expenses and losses as a commission from a client. One-third of the commission received is in respect of work to be done next year. We’ll cover more about how to account for and process payments later.

Any changes you make to the trial balance must balance – every debit adjustment should have an equal and opposite credit adjustment. Having said that, it is more important to complete the question within the time allowed, without spending too much time trying to find out why your statement of financial position does not balance. As we know that accounting is done on the basis of the Accrual concept. As per this concept, we not only record the transactions that are in cash only but also those which relate to the accounting year whether in cash or not. In order to determine the correct profit and loss and the true and fair financial position at the end of the year, we need to account for all the expenses and incomes pertaining to the current accounting year.

When a company prepays for an expense, it is recognized as a prepaid asset on the balance sheet and it reduces the company’s cash (or payment account) by the same amount. The prepaid expense is deducted from the particular expense while preparing a profit and loss statement. Secondly the credit to the balance sheet unearned revenue account, represents a liability to the customer for services yet to be provided. Service providers require payment for cell services that will be used by the customer one month in advance. If the advance payment is not received, the service will not be provided.

Credit for increasing research activities in a short tax year

For information on disaster recovery, visit DisasterAssistance.gov. The Social Security Administration typically sends out payments on the second, third and fourth Wednesdays of each month. The Social Security Administration disburses its checks in multiple rounds throughout the month, so yours could be coming at another time, depending on your birth date. We’ll help you find out when your Social Security payment should arrive and tell you how your payment date is determined. If you just started receiving Social Security benefits, learn the best time to begin collecting your benefits and how to pause them for a bigger payout later. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

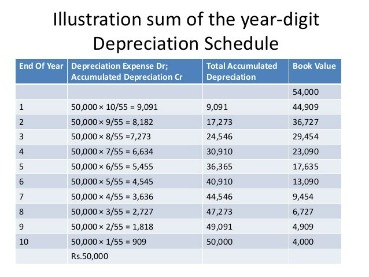

Under the income method, the entire amount received in advance is recorded as income. If a portion remains unearned at the end of the accounting period, it is converted into a liability. When a non-current asset is sold, the cost and accumulated depreciation relating to the asset are transferred out of the accounts to a disposal account. The proceeds of sale are credited to the account, and the balance on the account is then the profit or loss on the sale, to be transferred to the statement of profit or loss. You can check your calculation of profit or loss on disposal quickly by taking the proceeds of sale less the carrying amount (cost less accumulated depreciation) of the asset at the date of sale. In the normal course of business, some of the expenses may be paid in advance.

What Is an Advance Payment?

The accounting records will show the following bookkeeping transaction entries to record the income received in advance. The tax relief postpones various tax filing and payment deadlines that occurred from Aug. 27, 2023, through Feb. 15, 2024, (postponement period). As a result, affected individuals and businesses will have until Feb. 15, 2024, to file returns and pay any taxes that were originally due during this period. While getting your money upfront might seem like it can only benefit your business, there are both pros and cons of advance payments. This protection allows the buyer to consider a contract void if the seller fails to perform, reaffirming the buyer’s rights to the initial funds paid.

Malice Towards None & All: Fleecing & Maligning Citizens – thefridaytimes.com

Malice Towards None & All: Fleecing & Maligning Citizens.

Posted: Sat, 02 Sep 2023 08:12:00 GMT [source]

So, what is the alternative if the cons have instilled doubt that advance billing is right for your business? Billing in arrears—also known as deferred payment—might be better suited to your business operations. This article discusses the history of the deduction of business meal expenses and the new rules under the TCJA and the regulations and provides a framework for documenting and substantiating the deduction. The proposed regulations apply for tax years beginning after the date they are published in the Federal Register as final regulations. However, taxpayers may rely on the proposed regulations for tax years beginning after Dec. 31, 2017, provided they apply all the rules contained in those proposed regulations. The Income Received in Advance A/c appears on the liabilities side of the Balance Sheet.

When will I get my September Social Security check?

Individuals and households that reside or have a business in these counties qualify for tax relief, but any area added later to the disaster area will also qualify. The current list of eligible localities is always available on the disaster relief page on IRS.gov. Depending on whether you are making or receiving advance payment, the accounting process is different.

Outstanding expenses are recorded in the books of finance at the end of an accounting period to show the true numbers of a business. The credit to the liability account is made because the company has not yet earned the money and the company has an obligation to deliver the goods or services (or to return the money) to the customer. Accountants will state that the company is deferring the revenue until it is earned. Once the money is earned, the liability will be decreased and a revenue account will be increased.

Advance payments are recorded as assets on a company’s balance sheet. As these assets are used, they are expended and recorded on the income statement for the period in which they are incurred. In the ordinary course of a business, it may receive some income in advance in spite of not rendering the services. In the case of accrued income, it is to be added with the related income in the profit and loss account and a new account of the accrued income will be shown on the asset side of the balance sheet. It is the top line of the income statement, which represents the normal course of operation. The revenue will be reduced by the cost of goods sold and other expenses related to business operations.

In the process of accounting, an accountant is required to classify each expense and income and put it into a specific method and entry. This is done so that there is a definite procedure in the accounting system of the organization and the benefits of recording these entries are enjoyed. The benefits of a good accounting system include the correct estimation of provisions, calculation of net profit, and also giving a good glimpse of presentation. Income received in advance is the amount of cash that a customer paid to company before receiving goods or services.