If you use credit cards regularly, knowing your outstanding balance can help you keep track of how much you owe a credit card company. Keep reading to find out what an outstanding balance is and how it affects you. Opening Balance Equity accounts show up under the equity section of a balance sheet along with other equity accounts like retained earnings. In business, the closing balance is regularly presented by the organisation’s accountants to upper management at the end of each accounting period. You might also see closing balance in accounting referred to with the abbreviations ‘c/d’ for ‘carried down’ or ‘c/f’ for ‘carried forward’. When you look at your bank statement, your closing balance is always listed at the top of the statement, and indicates how much money you have available in your account.

- It is best to transfer opening balance equity accounts to retained earnings or owner’s equity accounts.

- The account balance is the net amount available after all deposits and credits have been balanced with any charges or debits.

- Failure to close out this account might result in a balance statement that looks unprofessional and possibly indicate an incorrect journal entry in your QuickBooks accounting records.

- It is not difficult to get rid of the opening balance equity account, all you need to do is make an adjusting entry that transfers the balance amount into the business owner’s retained earnings account or their capital account.

In QuickBooks, the opening balance equity account is listed as an equity account in the Chart of Accounts. When a new business file or fiscal year is formed, it is often generated automatically by the program. The account is identified as Opening Balance Equity and is situated in the Equity section of the Chart of Accounts. Sign up for accounting software to easily create and manage your opening balance equity account here. Keeping large credit card balances could lower your credit score even if you’re making payments on time. They could see you as a risky customer because you’re already using a large percentage of your available credit.

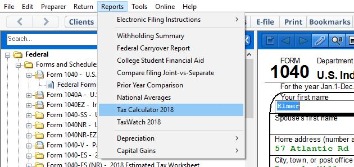

Step 5: Submission to the tax office

We will go over opening balance equity, the reasons it’s created, and how to close it out so your balance sheets are presentable to banks, auditors, and potential investors. On the other hand, an excess of total liabilities over total assets would result in booking a goodwill balance in the opening journal entry of the business. Maintaining a record of the closing and opening balance in the financial accounts of your business is a pillar of strong accounting practises. This is one of the main aspects of managing your cash flow and keeping track of a company’s financial health. After closing all the books at the end of a financial year, every business starts its new books at the beginning of each year.

For a credit card, various purchases may include $100, $50, and $25, and a returned item that costs $10. The account balance includes the purchases, which total $175, and the item returned for $10. The net of the debits and credits is $165, or $175 minus $10, which is the account balance.

Banking Transactions

Opening balance equity is the offsetting entry used when entering account balances into the Quickbooks accounting software. This account is needed when there are prior account balances that are initially being set up in Quickbooks. It is used to provide an offset to the other accounts so that the books are always balanced.

Survey of open science practices and attitudes in the social sciences – Nature.com

Survey of open science practices and attitudes in the social sciences.

Posted: Tue, 05 Sep 2023 10:43:28 GMT [source]

Translation of Opening Balance Adjustments applies the exchange rate (or entity currency / translated currency ratio for historical accounts) from the prior period. For Period 1, the rate / ratio applied is taken from the last period of the prior year from an override source scenario other than the current scenario. For the first reporting period of the year, the immediately preceding reporting period (the prior period) is the last reporting period of the prior year from the override source scenario. These transactions result from an intangible action, such as transportation, business services, tourism, royalties, or licensing. If money is being paid for a service, it is recorded as an import (a debit).

How does QuickBooks Online Handle Opening Balance Equity?

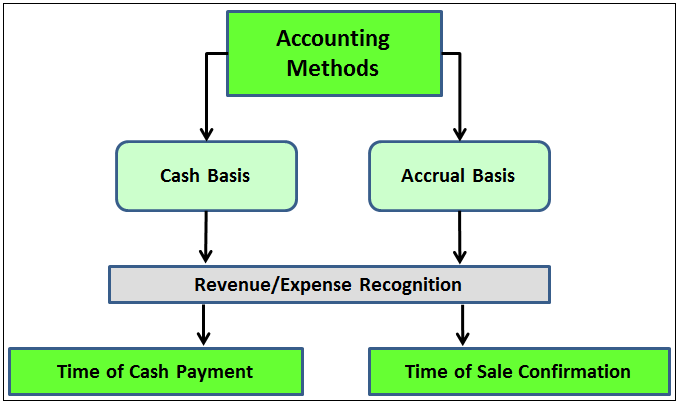

This guarantees the accuracy of the financial accounts and the balance of the accounting equation. If the journal accounting entry amount doesn’t match your bank account statement and you close it out, then the software will adjust the opening balance equity account balance. The opposite is true when the total credit exceeds total debits, the account indicates a credit balance. If the debit/credit totals are equal, the balances are considered zeroed out.

The account balance is the net amount available after all deposits and credits have been balanced with any charges or debits. An account balance is the amount of money in a financial repository, such as a savings or checking account. An account balance is also evident on billing statements for credit cards, utilities, and loans. Opening Balance Equity is the offsetting input which is used by you while entering account balances into the QuickBooks accounting software. This account is required when setting up QuickBooks when there are existing account balances. To ensure that the books are constantly balanced, it is utilized to offer an offset to the other accounts.

Meaning of opening balance in English

With the help of this software, you can import, export, as well as erase lists and transactions from the Company files. Also, you can simplify and automate the process using Dancing Numbers which will help in saving time and increasing efficiency and productivity. Just fill in the data in the relevant fields and apply the appropriate features and it’s done. Check the total sum once you enter all of your company’s opening balances in each account. To ensure that your QuickBooks firm balances on first day, you must put the identical amount into your opening balance equity account.

You can run into the opening balance equity account, while working with QuickBooks. Failure to close out this account might result in a balance statement that looks unprofessional and possibly indicate an incorrect journal entry in your QuickBooks accounting records. So that you can compare it with the closing balance sheet, your opening balance sheet needs to be ready at the time you difference between reserve and provision would normally prepare annual financial statements. Prepare your annual financial statements (in accordance with Section 264 HGB) within the first three months after the end of the fiscal year if the calendar year corresponds. In this case, you would need to prepare your sheet by March 31 of the next year.As mentioned earlier, the process is dependent on the size of your company.

San Ramon based Accounting & Controllership Company

It is simply an automated function programmed into accounting software demonstrating an issue with the previous term’s balance sheet. If your company is subject to accounting requirements, you will need to prepare an opening balance sheet for certain reasons. Your deadline will depend both on when you commence business activities and how large your company is. You should base this decision on the size and complexity of your company and situation.

When analyzing it, be sure to examine what is fueling the extra credit or debit and what is being done to counter the effects. However, expenses like utility bills, mortgage loans, or credit cards also have account balances. The starting balance equity account is used to record the balance of equity accounts at the beginning of a new fiscal year or accounting period for a firm. Opening Balance is the initial balance for an equity account which cannot be linked to a specific transaction or event, equity which is an account that is used to record the offsetting amount in the general ledger of the firm. It shows the discrepancy between a firm’s assets and liabilities at the commencement of a new accounting period, such as the beginning of a new fiscal year or when a new company is formed. It is not difficult to get rid of the opening balance equity account, all you need to do is make an adjusting entry that transfers the balance amount into the business owner’s retained earnings account or their capital account.

What is a closing balance?

This article will describe opening balance equity, why it exists, and how to close it out so that your balance sheets are presentable to banks, auditors, and potential investors. So, a deficit is not necessarily bad for an economy; especially for an economy in the developing stages or under reform. Sometimes an economy has to spend money to make money, so it runs a deficit intentionally. However, an economy must be prepared to finance this deficit through a combination of means that will help reduce external liabilities and increase credits from abroad. A surplus is indicative of an economy that is a net creditor to the rest of the world.